学校では教えてくれない、人生における重要なお金の教訓を知らない手はありません

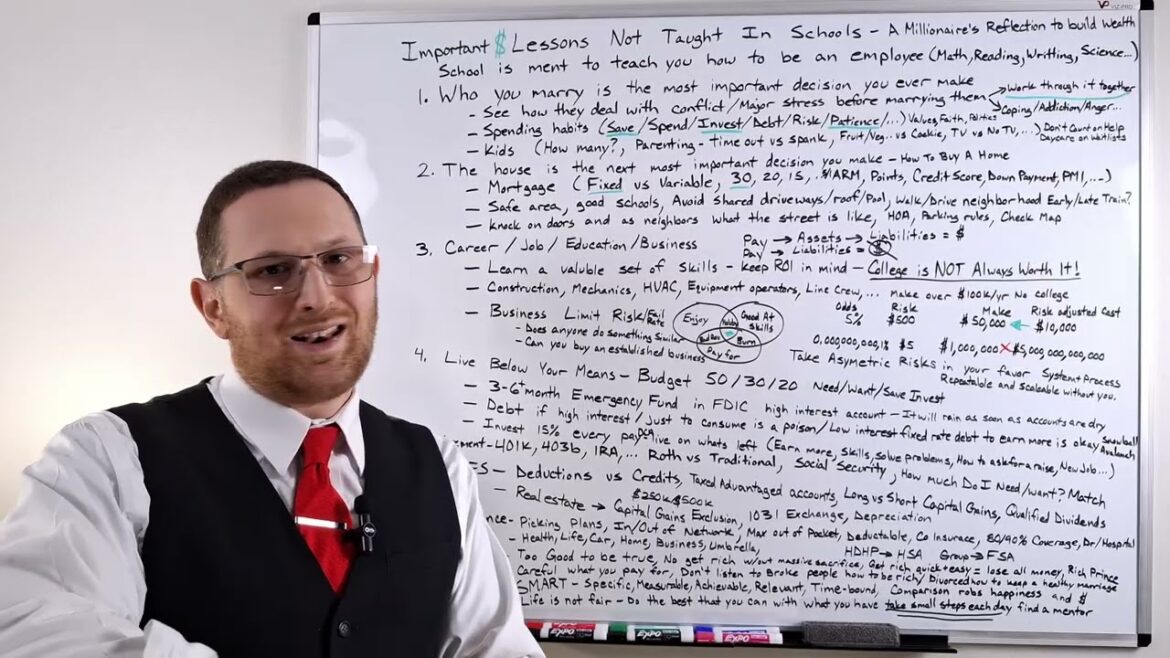

these are some of the key lessons that I’ve learned through life that are not taught in school basically all of this has to do with money in some way even your relationships i went from living in poverty and within 15 years I have a net worth of over a million dollars so if that interests you subscribe to the channel i cover a lot more of these in much more detail school was never meant to teach you to be an entrepreneur or to make you be rich in any way shape or form what school has been made for is basically teach you how to be an employee they’re going to teach you math how to read how to write bit of history things like that but it’s really geared towards making you an employee you have to take that information and go a few steps further if you want to do more in your life who you marry I believe is the most important decision of your entire life especially if you think about finances and just happiness in life so when you do that before I would get married I would want to see whoever I’m marrying i want to see how they deal with conflict how they deal with stress that could be a layoff that could be a sick family member that could be a whole slew of different things but pay attention during rough times how do they cope with it do they go through and work with you talk through it and maybe help come up with a better way or a solution to to solve that issue or do they turn to coping with like addiction beer do they have anger do they have drug use um do they become violent like h how is it that they react do they try to manipulate people you really are going to see somebody’s true colors when they’re under high stress situations think about it this way your spouse may love to save money and you like to spend money or you like to save and they like to spend how do they deal with that how do you deal with that is there a way that you can find a middle ground and you can enjoy life now while still save for the future which would be a healthy balance or is it swayed one way or the other and when they say they’ll do something they’re not following through uh that may be a red flag if someone’s saving and they want to plan for the future how are they with risk so uh let’s say somebody just wants to save the money but it’s not really earning any interest that person may not want to invest but investments may actually gather higher yields and higher returns which may turn out to be better over the long term uh how are they with debt is someone always using credit cards and going deep into debt paying high interest uh and then how is each partner with patience so if I want something am I okay to wait a year am I okay to wait five years or do I want everything today and therefore I’m putting everything on credit and uh loans and things like that and it’s being harder and harder to pay whatever my bills are so the big ones out of all of this is do you have the same values uh do you have the same faith why do I say faith well it’s it’s not as strong as it used to be but let’s say someone is Catholic and someone is um Jewish for example i’m just picking I’m not saying anyone is better than the other uh and it comes to Christmas time let’s say or uh Hanukkah or any of these celebrations for those religions what do you explain say during Christmas if you have children who’s Jesus Christ is that the son of God or is that someone that needed to be punished uh by crucifixion so the two different sides have to work that out so that becomes more of an issue when you have children it’s less of an issue if it’s just uh two people coming together but raising kids is a place where there’s a lot more friction uh between people the other one is politics so in the recent years in elections I’ve seen some couples break up because someone voted uh Democrat or Republican or independent or didn’t vote whatever that might be so if you don’t have alignment on your values your faith and your politics uh that can really pull people apart and I feel as though that faith and some of the values come more into play when you have children the other thing is kids do you want any kids do you want one kid do you want two three four how many do you want uh have that conversation before you get married one thing that comes out when you’re having kids is how are you going to parent the kids how are you going to discipline them how are you going to raise them with your values morals and beliefs so one may say “I want to put the kid in timeout when they do something or I want to talk to them.” The other person wants to spank them or or do something in that way so if the two people don’t agree on that that could be a conflict as well the other one is okay when the kids hungry what are you feeding them is it all fruits and vegetables is it all organic vegetables and fruits is it just any of it or are you okay with cookies once in a while every meal whatever that might be and people will fight over food choices for children as well the other one is are you okay to have tablets TV uh electronic devices such as that or should there be no TV no tablets or is there a certain compromise where they’re allowed a certain number of hours per day the other one is don’t count on help from others you’re going to hear a lot of people go “Oh I’ll have the baby all the time and whatever.” And and some people will follow through but don’t count on it get daycare lined up basically as soon as the kid’s going to be born because daycare generally has weight lists at least in the areas that I’m in and that could be anywhere from a couple of months to a year or more uh on the wait list so if you want to get into a a specific daycare if it’s in a certain proximity to where you work or where you live uh make sure to put them on the daycare list as quick as possible same with summer camps i’ve noticed that summer care is difficult to come by and you may need to schedule summer care in January so that they’re ready for uh June and I noticed they fill up very quickly so just things that a lot of people didn’t know i’d say the next major decision in life is where you going to live what house are you going to live in and I also have a video on how to buy a home and all the ins and outs of that go into a lot more detail basic things you have a mortgage uh you have options of fixed or variable variable would include like an adjustable rate mortgage an ARM uh they’re becoming more popular uh that caused a lot of issues around 2008 2009 for a lot of people going under and unable to pay for their homes i prefer fixed rate 30-year mortgages the reason being is that you have the same uh principal and interest payment portion of your mortgage for 30 years and yeah it might be slightly more expensive than the 20 or 15 uh but if you think about it I can always pay twice the principal each payment and that would automatically become paid off in about 15 years so that’s what I do for mine uh but if I were to say lose an income I still have the option of not paying as much money monthly and a lot of stuff happens throughout life you don’t know what’s going to happen i don’t know what’s going to happen you may have car accidents uh disease uh somebody may lose their job over a 30-year period uh there’s a lot of things that can happen so this just reduces my overall risk of that so I can reduce the amount of money I have to pay uh per month you can also have points i don’t use points whenever I uh buy a mortgage or buy a house uh because I may refinance it and the points are basically prepaying the interest i also have videos on how to get a better credit score but your credit is important when buying a home because you can actually save up to about 1% your interest rate and 1% on a half a million dollar house let’s say for instance is $5,000 a year or approximately $400 a month in interest just because your credit score is better or worse the down payment is typically about 5 to 20% if you want to get rid of your primary mortgage insurance which is an extra hundred or a couple hundred dollars a month uh up until you pay down 20% if you just put down 20% in the beginning you can avoid that uh from the beginning if you’ve already gotten a mortgage you can pay down some more of the money and once you get to a loan to value ratio of between uh 80 and 78% just notify your lender you want the PMI removed they remove it and you save a couple hundred a month it’s well worth it i would focus on looking for an area that’s safe has decent schools and avoid any shared driveways or roof i would also avoid having a pool the reason why I don’t like shared driveways say you share a driveway and the neighbor doesn’t want to take care of their stuff and the driveway is all ripped up and it’s causing damage to your car and they don’t feel like they want to fix it or they don’t have the money to fix it guess what it’s not getting fixed unless you fix their side as well and same with bad roof if my roof is going bad and their roof is already leaking let’s say I replace my roof because I want to make sure that my property is maintained but my neighbor might not be able to afford it or doesn’t want to replace their roof their problems become my problems cuz water’s going to come through that roof come through my wall and damage my house as well and I’m not the one responsible for all of that damage but I have to pay for it the other thing I would say is when I bought my first house I didn’t walk and drive the entire neighborhood i didn’t do it early or late one thing I found is I was very close to the border of a not so great of a place and I was in a town that was a nice town but since being on the border I could hear gunshots late at night and some other issues so I wish I would have done that before I bought that house uh the other thing I like to do is go knock on the doors of neighbors see what the streets like uh I avoid HOAs just because I like to build and grow my own plants and trees and things like that and I don’t want to be told uh what color my house can be or what color my door can be or what windows I can have so I don’t want the extra uh layer of government control through an HOA or where I can park my car things like that uh also they might not allow you to park or have parties at your house in an HOA depending on which one it is the other thing I like to do is check a map of my house the reason I do that is because I want to see if there’s any trains behind me or there’s a police station or a fire department that may make a bunch of noise if I’m a light sleeper and think about am I a 9 to5 person second shift third shift do I have kids uh keep that in mind as you have that i would also suggest always getting a house that’s at least uh two or three bedrooms and has one and a half baths the reason why is because that’s what people want to buy so if people want to buy those homes and I have that house and I want to move it’s easier to sell that house if it’s a one-bedroom house with one bathroom I’m not going to be able to sell that to many people basically my only option would be either a retiree or somebody that’s single so if you notice I put one is who you marry two is what the house is because if I overpay for the house I’m going to be paying for a long time the third most important thing I would consider is my career a job my education business that sort of thing why did I put it in this order cuz if I marry somebody that spends everything I make anyway and goes deep into debt it doesn’t really matter how much money I make it’s always going to be the same i’m going to be broke even if you make a million dollars a year but your spouse goes out and spends $2 million you’re going to have a problem if the house I have is you know a million versus $250,000 one’s much easier to maintain to to pay off and uh it’s much less of a stress on our income uh so that decision is also going to be made with who I marry no matter which of these I have the goal here is whenever I get paid I want to buy assets and I want my assets to buy liabilities wherever possible because that’s where I have money and then the assets keep producing money even if I don’t go to work if all I do is I get paid and I buy liabilities cars a house you know purses watches uh cell phones TVs that sort of thing there’s not going to be any money left over so I want to always pay myself about 15% towards assets and then have those assets eventually free me from whatever job or business that I’m working i don’t necessarily want to retire but it gives you the option to do that and you can do that much earlier if you wanted to so the main one here learn a valuable set of skills what do people need what what do they want so I’m going to keep my return on investment in mind college is not always worth it what do I mean by that well let’s say the college tuition is $40,000 a year and I’m looking at a job that only makes $30,000 a year so I’m going to spend $120,000 on tuition i’m going to come out with all this college debt and then I’m going to start working and not even be able to make that amount of money to pay it back in a short period of time so I’m going to be working for many years i might as well just went out to work because I can make much more than $30,000 with no college education there are many jobs that still pay well over $80,000 or $100,000 a year if you have ever heard of the concept of dirty jobs with Mike Rowan that’s kind of the same idea if you would like to be a plumber a carpenter an electrician you can get all that information from either working as an apprentice and a journeyman or you can go into a trade school so for me I didn’t go through a trade school but at the age of 12 I started doing uh pool construction you know laying concrete uh that sort of thing i learned a lot of trig with 3 four five triangles and squaring up corners with steel beams and stuff like that so it was a lot of fun and then I worked into home construction and made decent money there as well so as you can see here construction mechanics HVAC some of the equipment operators line crew they can make well over $100,000 a year and it’s no college education required so if you want to be an entrepreneur you want to start a business first thing I want to do is limit as much risk as possible so there’s things like LLC’s and other things that can uh reduce your liability in case it goes bankrupt uh but it’s also how much money am I putting up upfront so I have a bunch of videos here where it shows you how to make over $100,000 a year uh starting landscaping businesses and uh commercial farms and things like that with as little as $1,000 to to get started with that um so check those out as well i also go through the failure rates of different businesses say if I want to start a business from scratch generally about 5 years half of the businesses have closed now if you start a franchise cost a little bit more money upfront but they solve a lot of problems with computers logistics uh hiring you know menus advertising things like that they have a much uh higher success rate so they even have less than a 1 or 2% failure rate in some of these and uh I have a video on that as well so if I’m going to start a business there’s three things here I’m going to kind of put as a ven diagram so you’re going to want to do something that you would enjoy doing for a long period of time for many years and you want to have good skills at it and you have to do something that people are willing to pay for if all three of these things come together that’s a business idea if you only enjoy it and you’re good at it but nobody’s willing to pay for it that’s a hobby if you enjoy it people pay for it but you’re not great at that you get bad reviews no repeat customers most of your money comes from repeat customers so that’s what you want to focus on and if you have good skills and people pay for it but you don’t enjoy it you’re going to get burnout so really you need all three to have a really good business a good question is does anybody do something similar it’s actually a great thing if other people do similar things you can go to those businesses see how they operate see what they do well see what they can improve upon and then you can actually improve upon their weaknesses and keep their strengths and you could probably take a large amount of customers from going from there to your place the other thing is if those other places are still very busy it means there’s a lot of demand and there’s not enough supply so if you can enter that market offer another product very similar uh whatever that may be or service you may be able to gain a lot of clientele and um it just basically shortens the line at the other place you can also buy an established business so similar to a franchise there’s a lot of people that have a lot of businesses say plumbers mechanics things like this there’s a massive amount of baby boomers at the moment that are looking to retire that they can’t keep working or they don’t want to keep working and they have successful businesses but they don’t have kids that want to take over the business so they’re willing to sell it and they might just close shop so you could work with them you might not even have to pay them money today you can utilize their expertise of running this business for a number of years and you can use them as a mentor how to run that business and you can structure the deal in such a way that pay you know agree on the cost of whatever the business is with them but instead of having to fork over the money out of your pocket what you could do is structure the deal in such a way that with each year you pay out like say 10% of the profit of the business so they get the money they don’t have to keep working you get the business you can keep paying them off of the percentage of whatever that profit is they’re happy they’re getting their money each year you’re limiting your risk because you didn’t take and put a bunch of capital out and you found a solution for both of you so there’s ways to do this without a lot of money the other thing I want to point out is when people look at business or look at risk they don’t quite understand something so like if someone says “This is a million dollars do you want to buy it?” I don’t know what’s the risk what’s the potential reward i want to look at what those odds are and kind of gauge that let’s say for example I want to start a YouTube business let’s say I have a 1 in 20 chance of making you know significant income let’s say $50,000 and so my odds are 1 in 20 or 5% the risk maybe I have to buy a cell phone with a camera such as this which you can use that as your normal phone so you don’t have to put that much money out you might want some lighting uh maybe a stand but less than $500 let’s say total risk so if I take 5% so the $500 divide by 5% I come out with a risk adjusted cost of $10,000 is what I’m effectively doing if I did this 20 times so what would I potentially make for one in 20 people probably make about $50,000 so if I were to risk $10,000 would that be a wise risk to make $50,000 i would take that deal over and over again so that seems like a good deal let’s say I take the lottery and this is why people say the lottery is basically a tax on people that are not good with math or the poor and let’s say that lottery ticket cost $5 but you have this very small percentage chance that you actually win the uh total winnings if you did win is a million dollars in this instance but what is the risk adjusted cost you’re looking at $5 trillion so I would never take that risk because it’s pretty much worthless like I would much rather take this risk time and time again and multiply my money uh with those risks if I take enough chances at it take asymmetric risks that are in your favor try to look for systems and processes that you can use to drive efficiency and also you want to be able to have it so repeatable and scalable that you make money in your sleep for instance why did I do this on YouTube one to help other people as well as to um give my family and friends a a way to repeat what I’ve done as well as if I was not here in the future my daughter could watch them years from now but the other reason is because YouTube offers a system and a process where I don’t have to constantly be teaching somebody they can just click on this days weeks months years later and I still get some amount of revenue from the ads and things like that number four live below your means basically you want to budget and I almost want to flip this around but basically you have 50% is what you spend on what you need 30% is on what you want 20% should be some uh combination of savings and investing i would say you want to be able to invest about 15% or more uh starting in your 20s uh until retirement so that you have a comfortable retirement when you get there first thing I always do you start off with some amount of emergency fund uh you know 3 to 6 months would be great if you can only get $1,000 together there’s no real magic number it’s just have some amount of money that gives you a cushion in case the car breaks down or there’s an emergency somewhere and that makes that emergency from basically taking over your life and causing issues emotionally and in your relationships to just a money problem so it’s much easier if your transmission goes or your starter or something in a car and you’re able to just pay the bill and go back to work and it’s not like freaking out and things like that so have an emergency fund uh if you have 3 to 6 months that would be best and where would I put my emergency fund well I would put that in FDIC highinterest accounts um just realize that it will rain as soon as accounts are dry so when you don’t have money it seems like that’s when all the bad things happen and then you’re like ah shoot what am I doing so if you have money in an account it seems like it just kind of keeps the problems at bay so I don’t know why but that’s how it always happens if you have debt if it is high interest and it’s just to consume it’s basically a poison it’s taking money from your future you to pay for what you bought in the past and you’re making the credit card companies rich if you have low interest fixed rate debt to earn more is okay uh if it’s basically to buy a house like a 30-year fixed rate mortgage um that’s okay so you have a snowball method or avalanche method and the difference between those two are basically you could with the snowball method you pay off the smallest principle first just to get a quick win basically when you see progress and you get one less bill every month it’s more of a habit the reason why people get into debt isn’t because they’re good or bad at math they’re getting into debt because it’s more of an emotional thing it’s that the emotional response is what you have to break from this so you have to get a couple of quick wins to see that you’re making progress so paying off the smallest principle first you get progress and you’re like “Oh this is good.” And then you take that amount of money and you pay that towards the next uh lowest debt and you pay that off and you keep going through that when you’re doing that uh you feel better and better about that and more confident that you can achieve the goal mathematically it’s not the best way to do it but you know how people actually operate it’s the best for me I paid off the highest interest debt first and I paid everything off and was debtree within about 2 years uh for all my school debts and car debt and and that sort of thing but I paid highest interest first because I’m a math guy i’m an engineer and that’s just me i learned that put at least 15% away every pay use dollar cost averaging where you’re buying every pay period the same dollar amount of stock regardless if it goes up or down you’re buying at the lows you’re buying at the highs and over time if it’s good quality fund it goes up um there may be some down periods and you’ll see ups and downs realize that prior performance does not guarantee future performance investments can lose value after you’ve paid yourself through your retirement accounts and tax advantage accounts you’re going to live on what’s left so some people will say “Well there’s not enough money to live on.” Well how is it some people have millions of dollars a year and they’re still broke and other people make $40,000 a year and they’re still broke there has to be some point where there’s just lifestyle creep there’s a lot of things that we want that we buy that we don’t necessarily need to have i won’t go into detail with that here but I have videos on that as well so if you think that you just need more money you earn more money you acquire new skills you want to focus on how do you solve other people’s problems and I have videos on how to ask for a raise how to go for a new job things like that number five retirement accounts so uh a company sponsored retirement account could be a a 401k if it’s a nonprofit could be a 403b there’s individual retirement agreements or accounts depending on who you ask and there’s a bunch of uh public service ones as well what you’ll find with a lot of these is you have the option of a Roth versus a traditional so basically with a Roth you put money in today after taxes and then you can withdraw it tax and penalty-free depending if you at least go to 59 and a half years of age or it’s been open for 5 years and it’s used for u you know 10,000 down for a primary home or a few other things traditional accounts are similar in that they have tax advantages but the money that goes in with a traditional account you pay taxes when you withdraw the money you don’t pay taxes today so if you think you’re going to be at a lower tax bracket in retirement uh traditional is better if you think you’ll be at a higher tax bracket in retirement Roth is better um or you can do a mix of both i also go through how much does social security cover so generally covers about 40% if you’re under $100,000 uh and generally you want to cover about 80% of your pre-retirement income so about 40% here and you probably want about 40% in your uh retirement account to to cover everything and also there’s a question of how much do you need so do you need 80% of your pre-retirement income uh or is that just what you want do you want 100% 200% how do you want to live uh also with a lot of these say 401ks 403bs things like that you may have company match and that could be anywhere from a couple percent up to maybe 12% so it depends who you work for taxes so I also discuss what are deductions what kind of credits could you get what are tax advantage accounts such as these retirement accounts here uh if you have a non uh retirement account what are the capital gains on long or short-term uh basically long-term capital gains have a lot more benefits where you might only be taxed maximum of 20% or maybe it’s 0% depending on your income uh short-term capital gains are basically taxed at your normal income you could also have qualified dividends so depending on how long you hold the stock when the dividends paid uh you may be taxed similar to long-term capital gains and pay a maximum of 20% if you have real estate real estate is benefited with taxes so let’s say I had a house I sold the house I was able to use a capital gains exclusion so you can make as a single person $250,000 in capital gains from the sale of a property but if I’ve lived there for two of the prior 5 years I don’t pay any taxes on $250,000 if I’m married I can exclude up to $500,000 so that’s pretty nice if I have uh real estate and I sell it and I buy something in the same year I can use a 1031 exchange uh I can also use depreciation to reduce my taxes there’s a bunch of different tricks of uh wealthy people can use uh and when I say wealthy people it also means middle class lower class you can take advantage of these things and the reason why people are wealthy isn’t because they had a bunch of money to start realize that 80% of millionaires were not given any money so they started out they worked a number of years they got to about the late 40s when they became millionaires and they just apply the same principles the same laws and rules that the rich do number seven insurance i go through like how to pick plans how to go in network out of network what does that mean uh what’s the max out of pocket that I would pay what are my deductibles is it a low deductible plan or a high deductible plan if I have a high deductible health care plan uh then I can have an HSA i can invest that money if I have a low deductible I can use a uh basically a flexible spending account where I don’t have to pay taxes on the money that I’m using for healthare what’s my co- insurance so that’s the amount of money that I pay out when I go to the doctor uh and then I want to know what my coverage is a lot of them have 80 or 90% coverage and do realize that when you go to a hospital the hospital may be in network this is kind of tricky but the doctor that is working at the hospital may be out of network so you may actually get an in network bill and an out of network bill just because the hospital’s in and the doctor’s out or vice versa uh go through health care uh life insurance car insurance there’s home insurance you have business insurance umbrella this was interesting uh we had uh my wife’s grandfather actually ran into a building but at least he had umbrella coverage so this is an extra million dollars of liability coverage on your car and house and other things so if you get in an accident um and and someone’s hurt you’re not using the minimum uh insurance so you would have a couple hundred thousand on the vehicle insurance and then the umbrella would add another million dollar insurance so that helped care for the people that uh he got in an accident with uh without going after his personal assets so that was uh good that he had that number eight I’ve seen a lot of scams throughout the years if it seems too good to be true it’s it’s probably a scam uh just realize that if anything is like get rich quick uh without a massive sacrifice it’s it’s a scam basically if you try to get rich quick and it’s easy and anybody can do it you’re looking at losing all of your money by the way we none of us are related to a rich Nigerian prince that wants to give you millions of dollars if someone wants to give you advice be careful what you pay for but do listen and try to extract whatever information you can from that because there’s a lot of people out there that are very intelligent but listen to them in their field of expertise what I mean by that is I would talk to a carpenter about carpentry i would talk to a mason about masonry a mechanic about fixing cars but I’m not going to ask and listen to broke people telling me how to be rich i’m not going to go ask somebody that’s divorced how to keep a healthy marriage i’m not going to ask somebody that’s wildly out of shape how to stay in shape see what they did if they’re doing what you want to do or have succeeded in the areas that you want to succeed ask for advice from those people the other one is goals so I’m going to list smart so you want specific measurable achievable relevant and time bound uh goals in mind and the reason why I wrote it out that way is let’s say I want a th000 subscribers within 6 months of starting YouTube how would I do that i would say I want a,000 subscribers but that’s an output that’s not what I’m putting in so I’m going to say I want to create over a 100red videos within two months so I can measure 100 videos it’s very specific it’s measurable uh could I do it in a month well I need three per day is it relevant yes it’s relevant to where I was trying to go uh time bound it’s within 2 months so that’s a smart um goal so I was able to achieve that in 2024 uh and now I’m at over 30,000 subscribers and and going so the other thing is comparison robs happiness uh and basically money so don’t compare your life to other people’s lives there’s always going to be someone that has more there’s always going to be somebody that has less be happy with what you have uh try to do better each and every day take it step by step it’s sort of like if somebody’s trying to get in shape or to lose weight the weight didn’t come on you know overnight where somebody puts on like 100 pounds you can’t just uh go on a full diet where you’re not eating or something like that it’s not healthy you’re going to crash and it’s not going to change anything but if you make small habit changes so if it was trying to lose weight trying to cut out soda uh trying to eat more fruits and vegetables uh do things that I enjoy and pick those areas one bit at a time that that’s how somebody would achieve that goal if somebody’s trying to become financially independent and and you know have a lot of money uh in order to live uh securely it’s not going to happen overnight it’s going to take a couple of years probably to get there but if you take small incremental steps so maybe somebody can’t put 15% away uh each and every week but maybe they could put 1% and then the following year they put 2% the following year they put 4% each time they got a raise they could do a small step towards that that would be towards your goal so just always ask yourself is this putting me towards my goal or is this taking me a step back from my goal and try to pick things that put you in the right uh position also realize that life is not fair do the best that you can with what you have again take those small steps every day i would highly advise you to try to find a mentor that has achieved what you want to achieve and one of the ways to get them to help you is see what goals they have and try to help them achieve their goals by you helping them to achieve their goals even if they’re not paying you you will learn more from that mentorship than money could have bought you so I’ve had many mentors throughout my life i’ve helped them in many ways and I’ve become a much better person because of it as well as I’ve made a lot of money and I’ve been able to invest and uh basically take risks i’ve gone from basically going to food banks and churches for food because as a kid we didn’t have food and we didn’t always have running hot water or electricity or heat in the winter and that sucked and I never wanted to do that again so when I said I’m going to have my family I wouldn’t do that to them so now we have all those things our bills are paid for months in advance and you know it’s a much easier life so it’s easier for me to do the hard things now to prepare for you know a rainy day a year or two years from now or something like that so that’s why I do it well thank you for watching if you’d like to subscribe I cover how to make more money how to save how to invest how to be an entrepreneur all those things are covered here there’s also a free uh Discord channel where people can talk just realize if you go on the Discord channel sometimes they have uh scammers try to pretend to beat me so just realize that I don’t ask for money from anybody and I’m not trying to sell you anything i just have conversations with people about once a week it’s generally after uh 8:00 PM when my family’s uh sleeping so all right well thank you for watching please subscribe and have a great

10 Most Important Financial Life Lessons Not Taught In School. Things not taught in school important for success. You Can’t Afford Not to Know These Key Financial Life Lessons Not Taught in School. Marriage, children, real estate / home, job / college / business, investing, budgeting, getting out of debt, emergency savings, scams, mentors, taxes, risk, building wealth / how to become rich, spending habits, and many more.

Disclaimer and safe Harbor statement:

Topics discussed may include predictions, estimates or other information that might be considered forward-looking and results are not guaranteed. Prior performance does not guarantee future performance. This is not individual investment, legal, or tax advice. Investments carry risk and can lose value. Make sure to complete your own due diligence and work with licensed investment, tax, and accountant professionals when making financial decisions. Topics discussed and opinions provided do not represent any current or past employers of Financial Freedom 101 staff and are given as personal opinions. Financial Freedom 101 is not responsible for any of the financial decisions that you make. Financial Freedom 101 typically has investments including, but not limited to positions in diversified ETFs and mutual funds such as SPY, VOO, SWPPX, FXAIX and others which may contain holdings in the companies discussed. The content of this video is for entertainment purposes only.

14 Comments

First. Thanks econ Dad

Looking sharp dude 😮💨

Totally agree with #1. I will add that one spouse will always be more of a spender than the other, one will be messier than the other, one will be more extraverted than the other. It’s all relative, so don’t marry someone TOO far away from you in these areas, and both of you must be willing to be made better by the relationship.

Great Advice Man, Really Appreciate it !!!

I dropped out of school just so I can binge watch your videos 🧠

School was baby sitting us until we got to college and uni and then the shit really hit the fan that it was wasted potential.

But i am glad for this youtube video right here giving crash courses.

I can't believe the gullible people who believe they are distantly related to a Nigerian prince. I'm much smarter than that and found a Nigerian diamond miner who is willing to share his profits with me and just needs me to transfer some money for him to get off the ground. Boom! 💪💸💰

love the beard goat, thank you

Thanks for the great videos!

I think that one other really important point is to live a healthy lifestyle. This includes diet, exercise and overall workload/ work related stress.

Good afternoon coach 🫡

I can't read well. make it easier😢 in the future nice video.

That’s it, amma start growing my beard too

Holy Smokes, I had NO IDEA how expensive Daycare is, that breaks down to $1400 a month! That's absurd, wow

My man’s a legends brother 😂